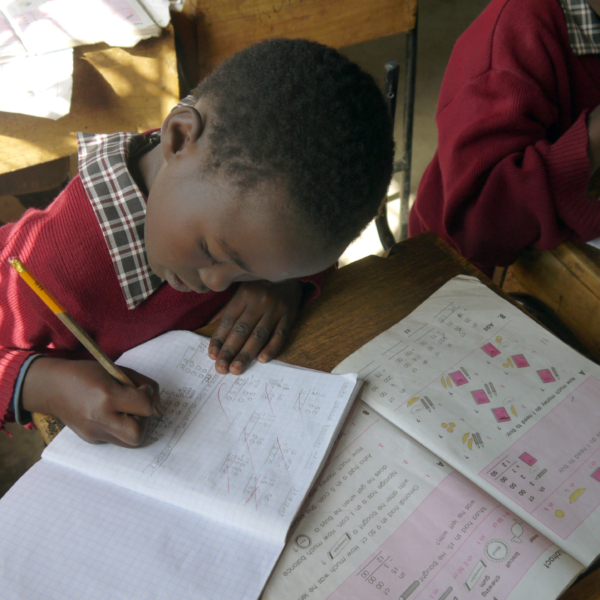

Our mission is to provide more children with a quality education and better opportunities in life.

African Adventures Foundation is a registered charity set up in 2013 to provide support to 29 schools in developing areas of Ghana, Kenya and Zanzibar.

These schools provide education, health and food security, and social support to young people whose access to these basic services would otherwise be very limited. African Adventures Foundation helps by funding food security programmes, the construction of important school facilities, and hygiene projects that will benefit children’s health and education. With your help, we can continue to provide security and opportunity for more children.

Our Key Areas of Focus

We fund four core programmes that help the schools grow their outreach and improve the quality of education they provide.

Food Security Programmes

We fund vital food security programmes at our partner schools in Kenya, giving 1,300 children two free nutritious meals every day, who might otherwise have to go without.

Infrastructure

We fund building projects needed by our partner schools, that range from new classrooms and kitchens, to toilet blocks and utility installation, such as piped water and electricity.

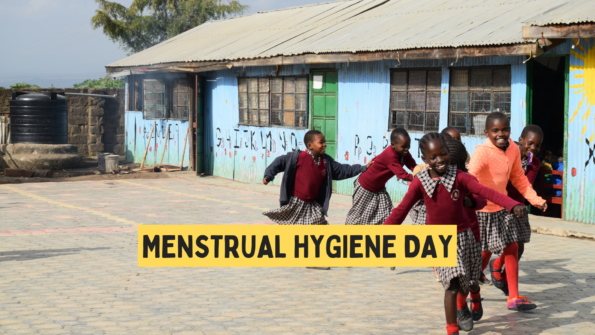

Water, Sanitation & Hygiene

We fund WASH (Water, Sanitation and Hygiene) projects to improve hygiene standards, including the construction of more toilet and washing facilities and educating children about menstrual health management, to help alleviate period poverty and provide equitable access to education.

Key Equipment

We provide essential classroom resources and kitchen equipment, to help our partner schools operate more. This can range from energy-saving cookstoves and cutlery to IT equipment and desks. Where there’s an urgent need, we run tailored fundraising campaigns.

Get Involved

We rely on the generosity of people like you to help carry out the important work we do in Africa. You can get involved as an individual, a group, or an organisation. From running a marathon to holding a bake sale, supporting our annual campaigns or making us your charity of the year, there’s something that everyone can do.

Take on a Challenge

Our supporters have pushed themselves out of their comfort zones and have achieved amazing things to raise money for our partner schools. The sky was the limit for Deepa, who raised over £3,000 by taking part in a sponsored skydive.

School Fundraiser

Wellstead Primary School is one of the UK schools partnered with African Adventures Foundation. For their first fundraising event – ‘Give Hunger the Boot’ – pupils at Wellstead wore wellie boots to school and donated £1 to the Foundation, making a huge difference to our partner schools.

Team Event

African Adventures staff and our supporters took on the Isle of Wight Ultra Challenge, walking 106 km or 54 km around the island’s coastal paths. They raised £12,500 for our Food Security Programmes, which has provided two daily meals to students at our partner schools in Kenya for seven months.

Christmas Meal Appeal

Our annual Christmas Meal Appeals aim to give each child at our partner schools a special Christmas meal and party, spreading a little bit of joy for the children at Christmas time, and relieving a little bit of the pressure on their families.